Conquer your finances with the 50/30/20 Budgeting Rule | A Beginner's Guide

Share

A Beginner's Guide to Budgeting: Conquer Your Finances with the 50/30/20 Rule

Budgeting may seem daunting, especially if you're just starting out. But fear not! There's a simple rule that can help you take charge of your money and achieve your goals. Enter the 50/30/20 budget rule. In this blog post, we'll walk you through what the 50/30/20 rule means, how it works, and provide you with practical tips to keep your budget on track.

1. Understanding the 50/30/20 Rule:

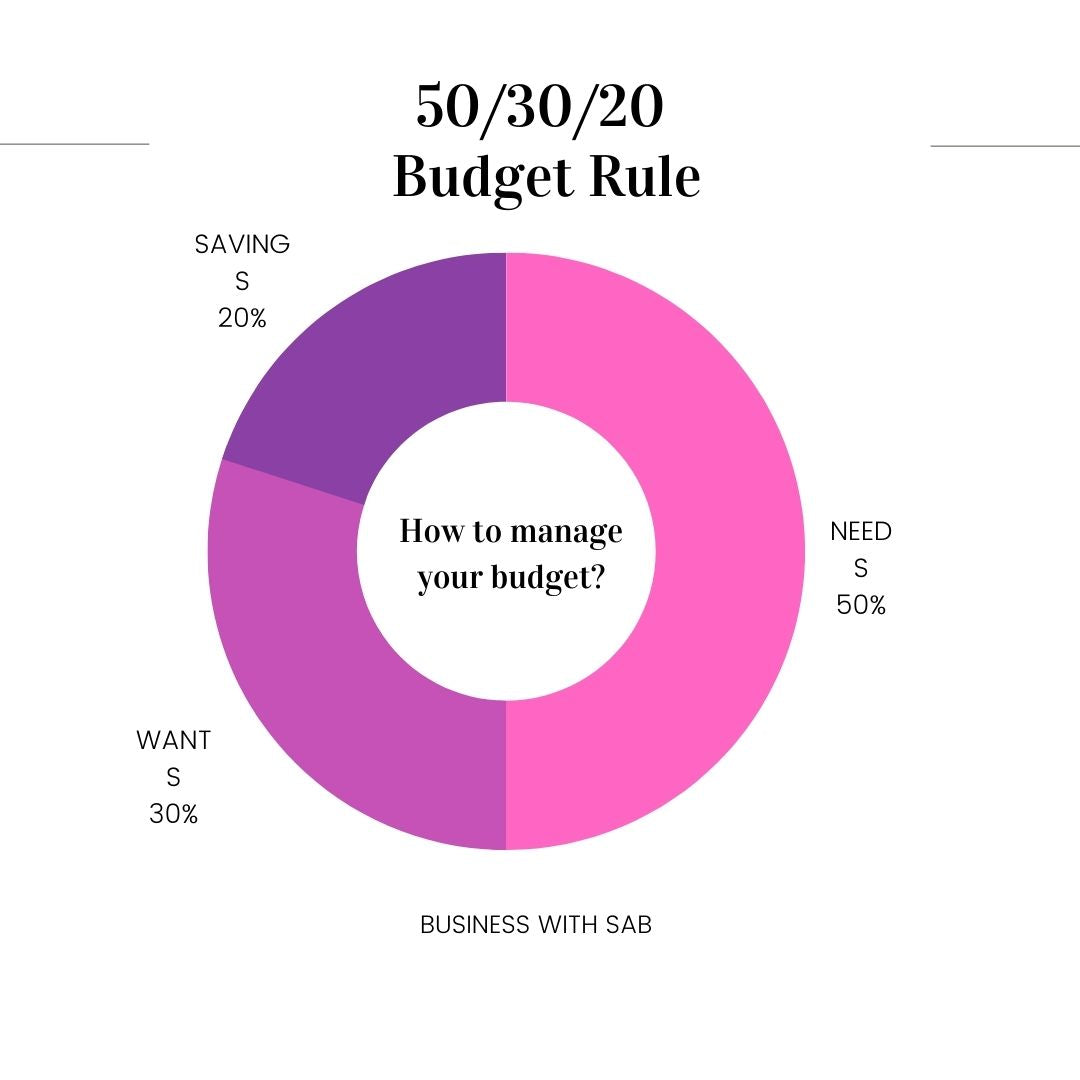

The 50/30/20 rule is a handy guideline for dividing your income after taxes into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Let's dive deeper into each category:

a. Needs (50%):

This category covers essential expenses like housing, utilities, transportation, groceries, and healthcare. It's the stuff you can't live without. Make sure to prioritize these expenses because they form the foundation of your budget.

b. Wants (30%):

Here's where the fun comes in! The wants category is for non-essential expenses that bring you joy and enhance your quality of life. It includes dining out, entertainment, travel, hobbies, and discretionary purchases. Remember, it's important to enjoy life, but keep an eye on overspending in this category.

c. Savings and Debt Repayment (20%):

This category focuses on building up your savings and paying off debts. It involves contributions to emergency funds, retirement accounts, investments, and debt repayments. By giving this category attention, you'll set yourself up for financial stability and long-term goals

2. Tips and Tricks for Staying on Track:

Now that you're familiar with the 50/30/20 rule, here are some practical tips to help you stick to your budget:

a. Keep tabs on your spending: Start by tracking your income and expenses. You can use budgeting apps or spreadsheets to get a clear picture of where your money is going. This knowledge will help you identify areas where you can cut back.

b. Set realistic goals: Determine your short-term and long-term financial objectives. Whether it's saving for a vacation, paying off debt, or building an emergency fund, having clear goals will keep you motivated and focused on your budget.

c. Automate savings and debt payments: Make your life easier by setting up automatic transfers to divert a portion of your income directly into your savings or investment accounts. Similarly, automate your debt payments to avoid missing deadlines and incurring unnecessary interest.

d. Prioritize needs over wants: While it's important to treat yourself, make sure your needs are taken care of first. This will prevent you from accumulating unnecessary debt and financial stress. Look for cost-effective alternatives for your needs, such as cooking at home instead of dining out frequently.

e. Review and adjust your budget: Life is ever-changing, and so should your budget. Regularly revisit your budget and make necessary adjustments. If you receive a salary increase or experience a decrease in expenses, consider modifying the percentages to optimize your financial situation.

f. Stay disciplined: Budgeting requires discipline and commitment. Resist the urge to make impulsive purchases and stick to your allocated percentages. Remember, the 50/30/20 rule is a flexible guideline, but maintaining a balance between needs, wants, and savings is crucial for financial stability.

Mastering the 50/30/20 budget rule is a fantastic way to take control of your finances and lay the groundwork for a secure future. By prioritizing your needs, enjoying your wants within limits, and saving for the future, you can achieve financial success and peace.